How high would European household electricity prices be without the various subsidies, tax cuts, compensation payments, price caps and other measures recently brought in to protect consumers from the energy crisis? You may be surprised.

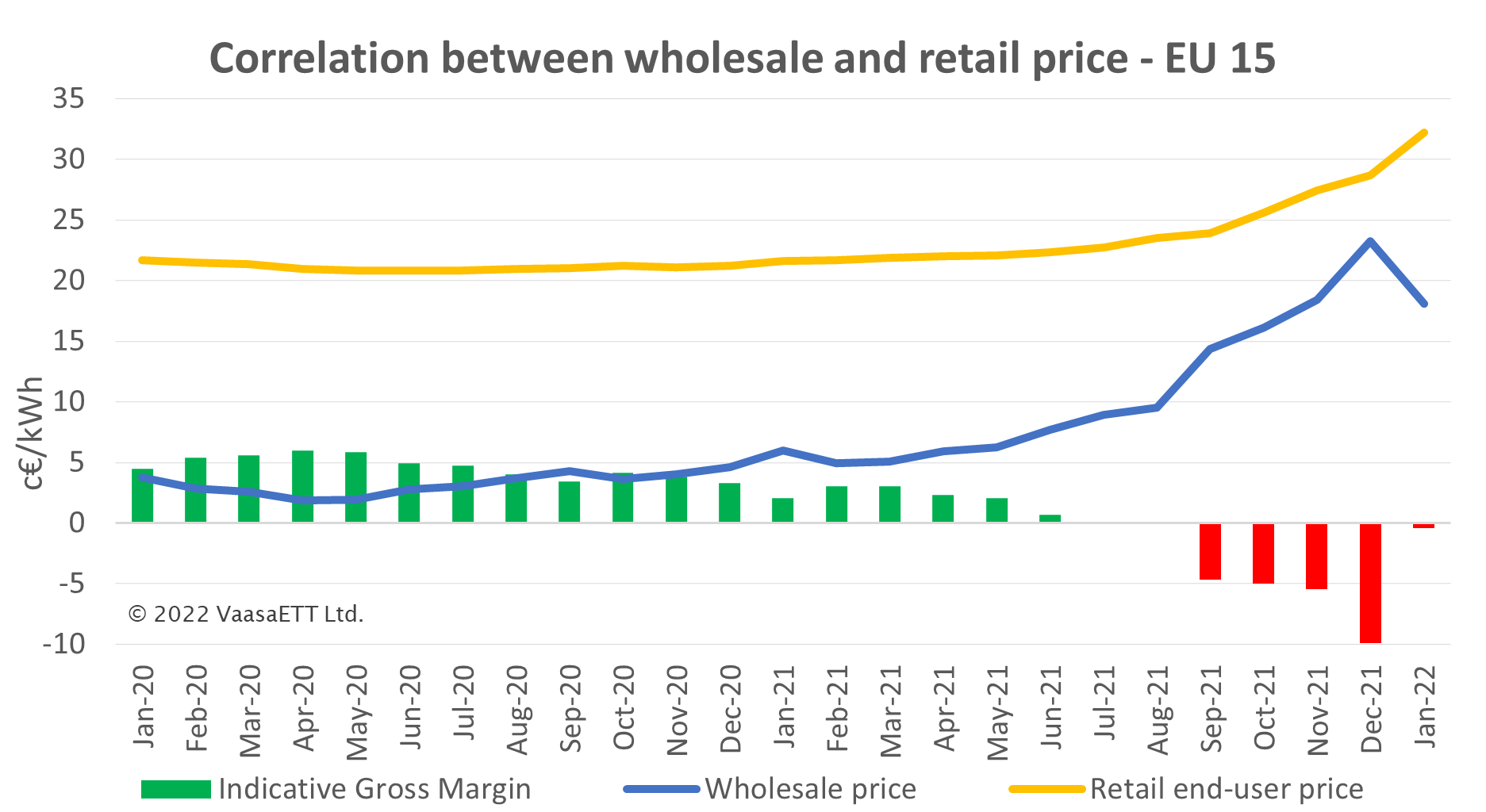

As we witness the recent developments in the energy market, much ink has been spilled on Europe grappling with an unprecedented gas supply crunch and soaring energy prices. After the resumption of the world activity and the economic recovery from the pandemic, wholesale prices started their upward trend, thereby affecting retail prices in the same direction. The phenomenon was mostly felt after the summer, when the majority of Europe was continuously facing significant price rises. Since then, new record-high prices every month became the norm, forcing governments to act and adopt measures so that the rise in prices would not pass entirely through to consumers. A mixture of subsidies, tax cuts (and removals), compensation payments and price caps have been implemented so far across the European countries to ease the burden of high electricity and gas bills on homes and businesses. In this article, purely for simplicity, we focus only on electricity bills.

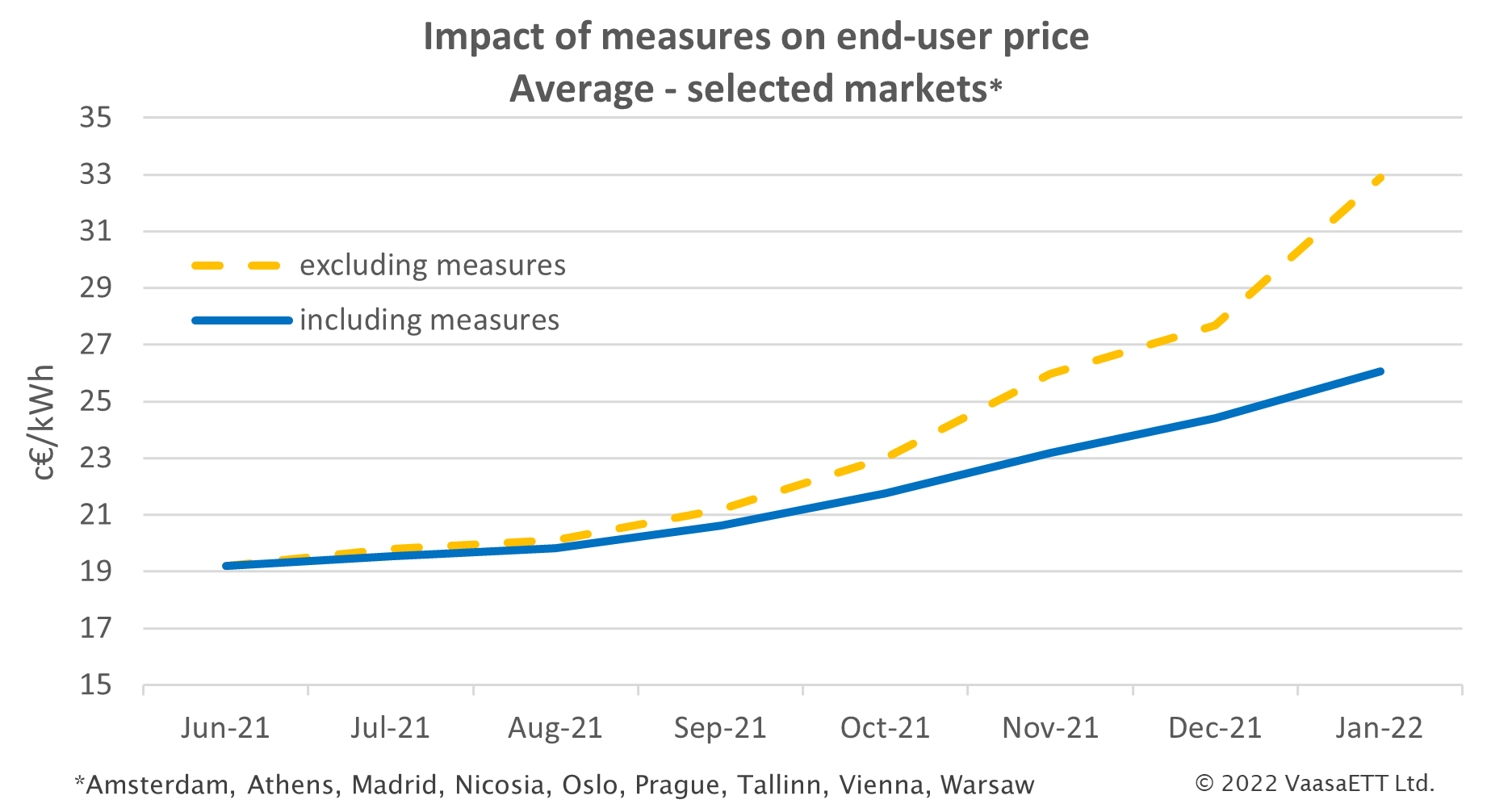

After several months of these measures, we can now examine their impact on electricity retail prices and consider the extent to which they may have served their purpose. How much did the prices actually restrain bills? To that end, we have studied the historical evolution of residential end user electricity prices in selected capitals, where measures [1] have been taken to limit the steep rise of customers’ bills and we reveal the apparent price evolution had these measures not been taken.

Tax reliefs

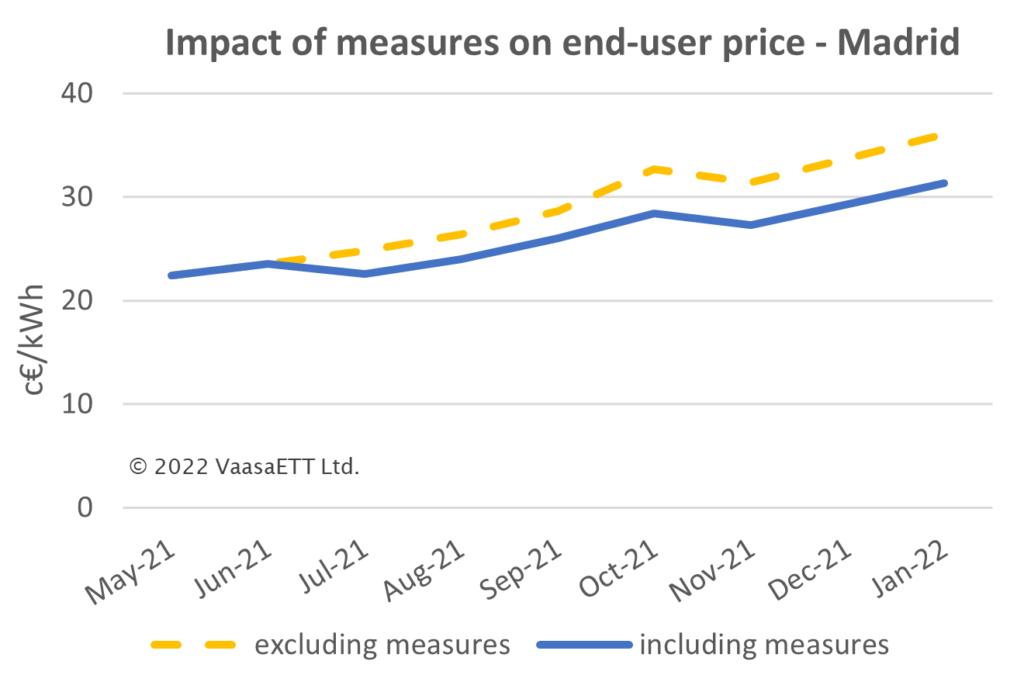

Spain was among the first European countries that announced any measures. VAT was reduced from 21% to 10% in July 2021, while in October 2021 excise tax was reduced from 5.1% to 0.5%, the minimum allowed. The measures gradually reduced end-user prices by 9%, followed by a 13% reduction in total, from October onwards.

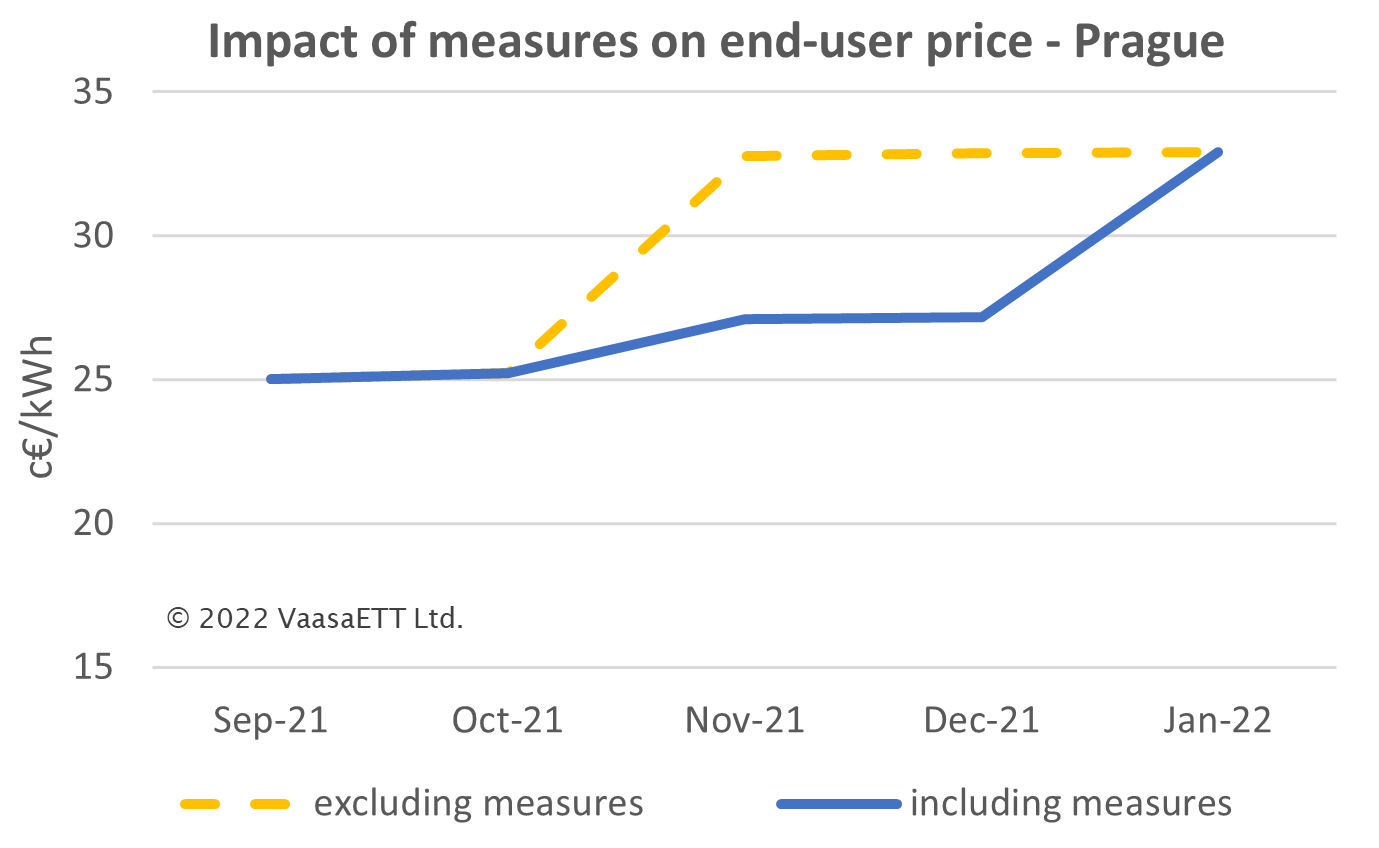

In the Czech Republic the adopted measure during November and December 2021 was a full abolition of VAT (21%), keeping the bills 17% lower than expected to shield houselholds. As shown in the graph for Prague, from January 2022 VAT returned to usual levels driving prices 21% higher compared to one month earlier.

The same strategy was followed by Poland where a package of tax cuts was introduced. By lowering the VAT to 5% from the previous 23% and at the same time abolishing the excise tax, a 15% price decrease for end-user customers in Warsaw was recorded in January.

Similarly, in Cyprus the government reduced VAT from 19% to 9% for three months (commencing November 2021), while announcing an additional 10% reduction on electricity bills from November to February. In Austria, the eco tax implemented six years earlier was set to zero, followed by an additional renewable tax suspension. Households in Vienna thus faced a 9% lower-than-otherwise bill in January.

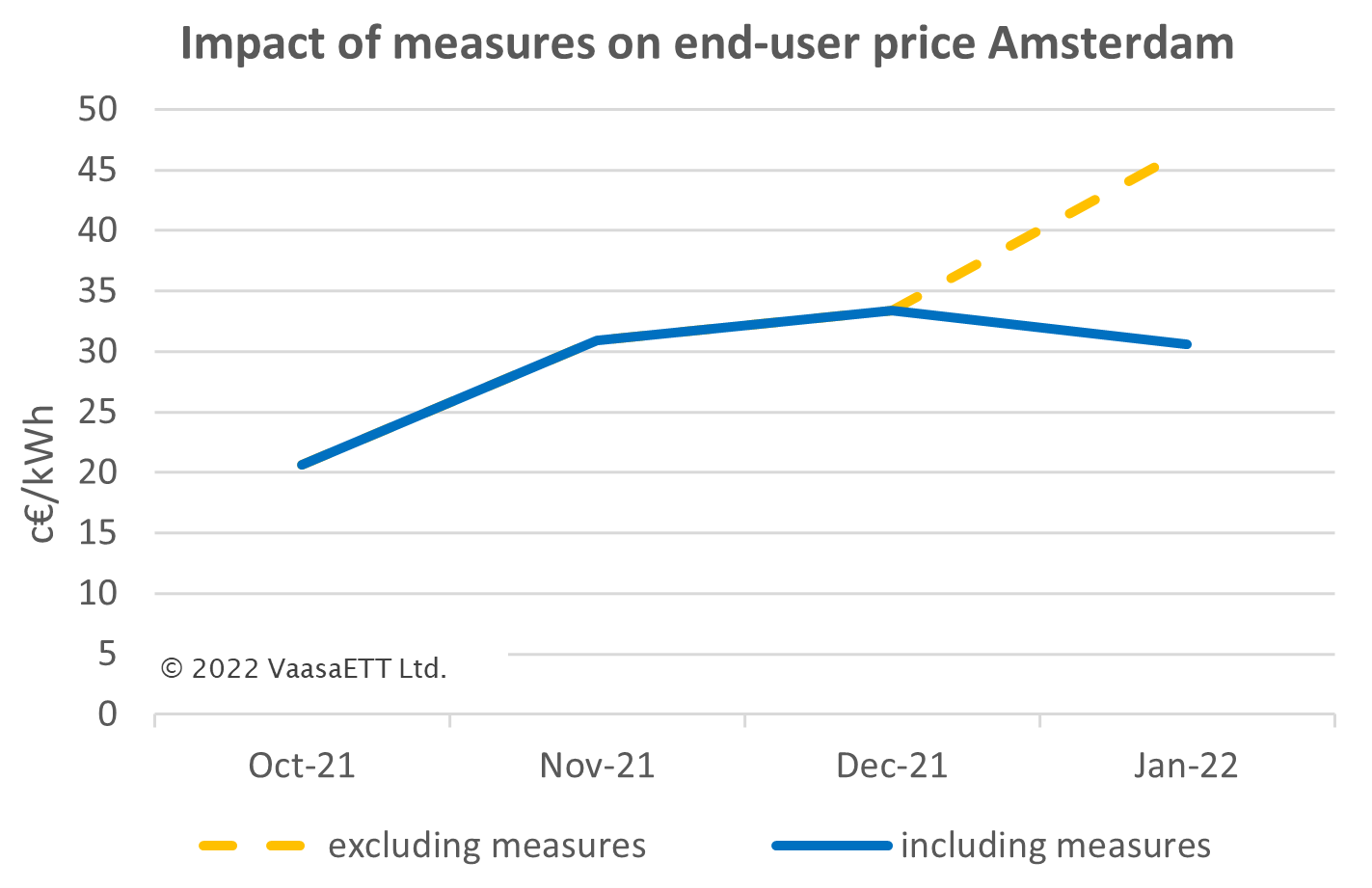

The Netherlands chose another approach, giving an extra reduction of 265€ in energy tax (from -559€ to -825€) for a typical household regardless of consumption. The impact of the measure is reflected in the graph for Amsterdam, showing that electricity prices for the consumers were not just restrained but decreased. If the energy tax had remained at the same levels, the end-user price would have been 35% higher in January 2022.

Price caps

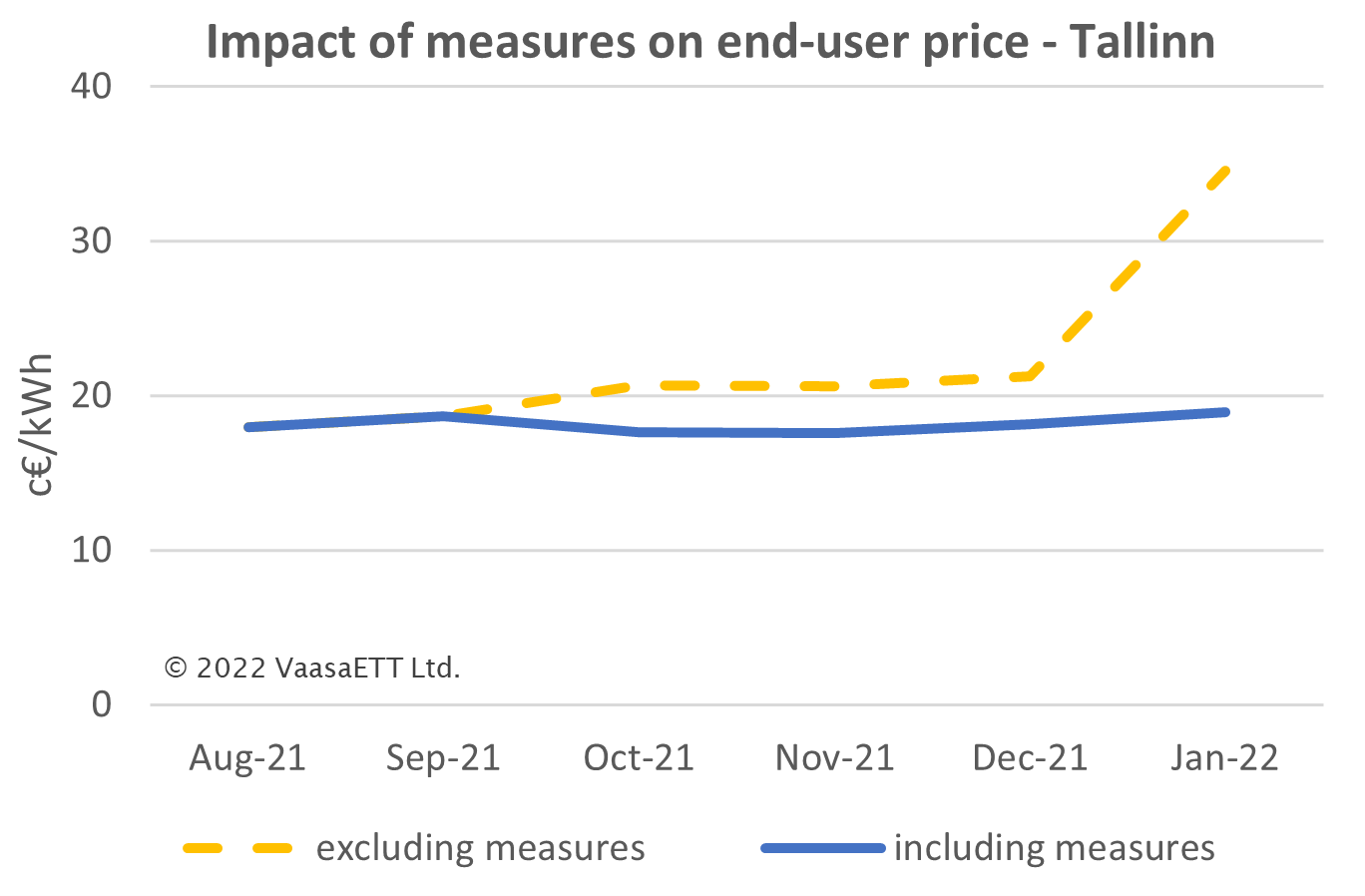

Starting from October 2021, Estonia reduced the electricity network fee by 50%, a discount directly reflected in residential bills. A 15% decrease was recorded in the end user price, followed by a total decrease of 45% in January 2022 due to the establishment of a price cap. The government set a price limit for household consumers at 12 €cents per kWh for electricity consumption up to 650 kWh per month. What is notable from the graph for Tallinn, is that the measures implemented in Estonia can be characterised as flattening, given the price stability that has been achieved since the summer and especially in January with the adoption of the price cap.

Compensation payments

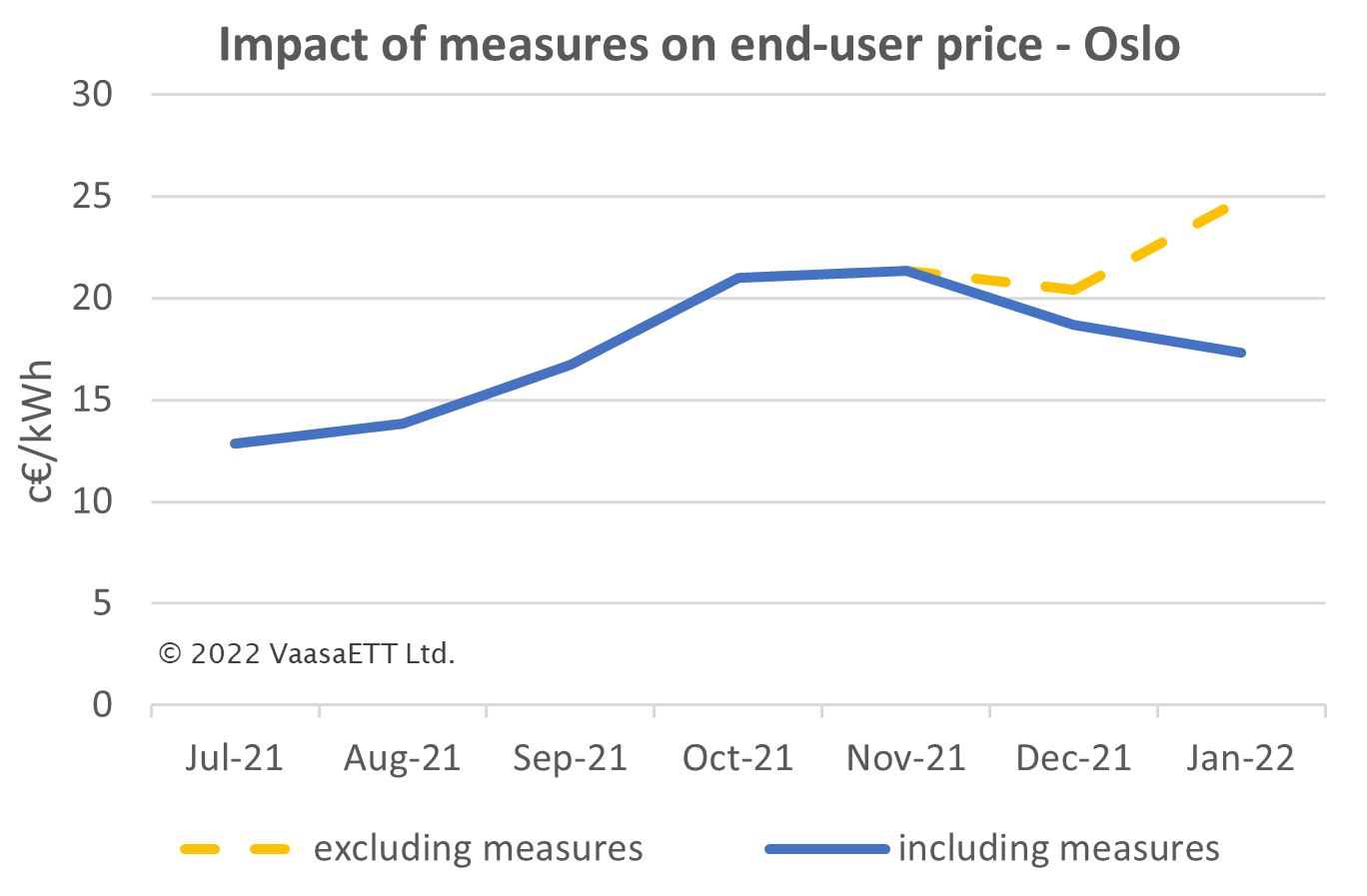

Prices in Norway were not only restrained, but even decreased after the government subsidised household electricity bills in December, initially paying for 55% of electricity costs above 70 øre/kWh, if the spot electricity price exceeded that level. In January, the percentage increased to 80%. This helped lower the end-user price by 8% in December. The impact of the measure was significantly higher in January 2022, as the sharp rise in spot prices combined with the increased compensated proportion contributed to a 30% reduced electricity bill.

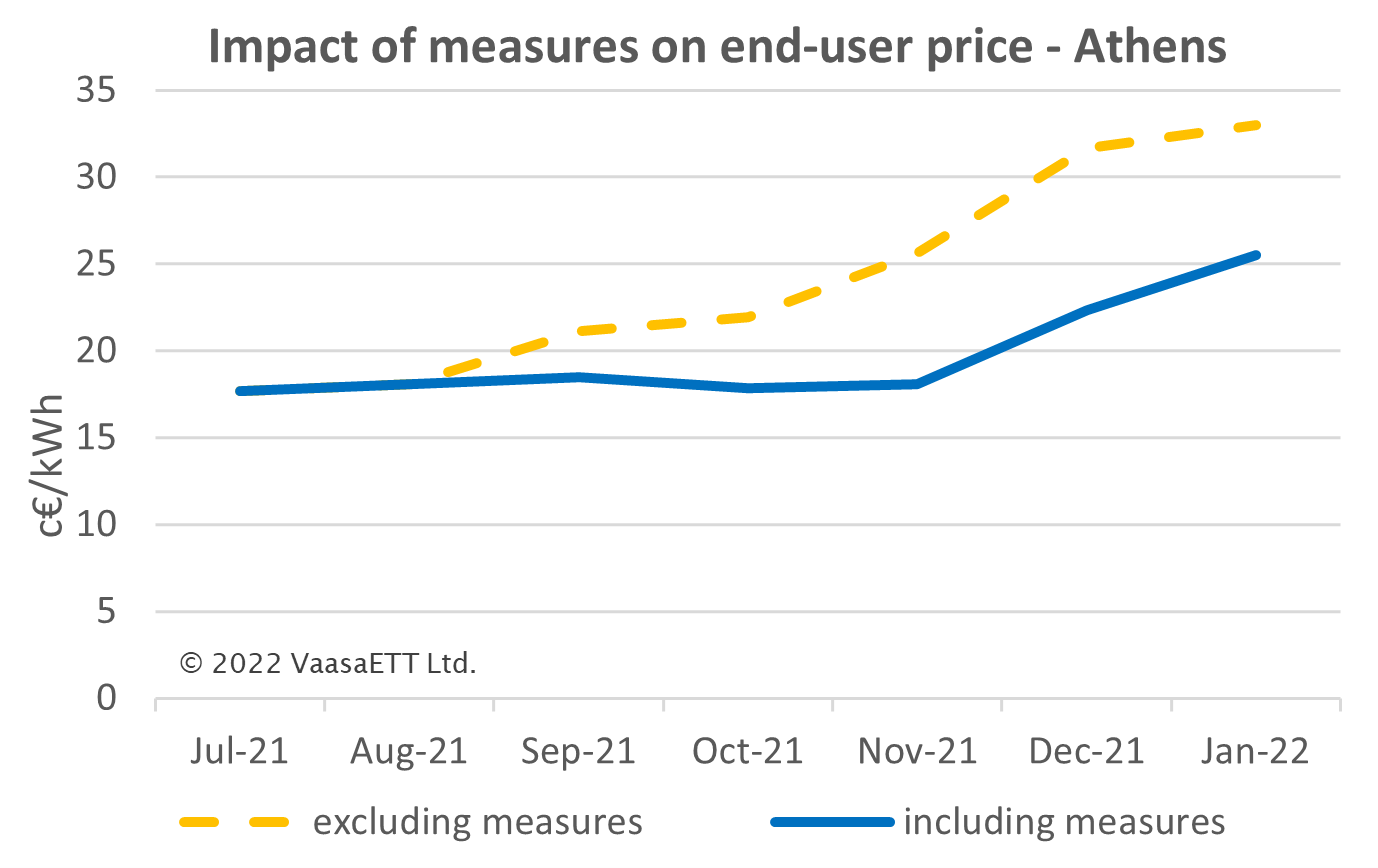

Greece was also one of the first in Europe to introduce emergency measures for the protection of households, subsidizing the electricity bills according to the level of consumption. 30 €/MWh compensation was provided for the first 300 kWh consumed in September. That was increased to 60 €/MWh for October, to 130 €/MWh for November and to 165 €/MWh for December. In January, the subsidy was adjusted to cover only the electricity bills of primary residences. The measure led to a decrease in the end user price by 12% in September, staggered in the following months up to 30%.

Overall, how much higher would the expected prices have been, had no action been taken by the respective EU states? Although the analysis is limited to selected capitals, the graph below is indicative of the impact that state aid had on residential electricity bills.

The effect of the measures on end-user prices was not significant until mid-autumn, when the majority of the governments started acting as sharp increases in wholesale prices began to affect household energy bills. Measures had a differing impact on end-user prices dependent on the nature of the action adopted in each country, minimising the increase, restraining prices at previous levels or even reducing prices. The most common measure among the studied countries was tax relief, which in most cases eased the increasing trend.

Overall, the average retail price in January 2022, when all the countries examined had already implemented measures, would have been expected to be more than 20% higher had no actions been taken. Nevertheless, high wholesale prices are still bringing pain to consumers. Temporary measures lifting some of the energy cost burden from European households, merely treat the symptoms and not the cause of a much bigger and more complex crisis.

[1] For this analysis, only measures that apply to the typical customer and not specific customer categories (e.g. vulnerable customers) have been considered.

0

0